how much will my credit score increase with a car loan

It represents your creditworthiness and the likelihood that you will repay. It all depends on how you manage the loan how much the loan is for and how you honor the commitment.

650 Credit Score Auto Loan Interest Rate What Can You Expect Is 650 A Good Credit Score

Ad Take out the guesswork with credit.

. The good news is financing a car will build credit. But the positive effects will last for the length of. Answered on Dec 15 2021.

The credit application you fill out for a car loan can temporarily lower your credit score usually by fewer than five points according to the MyFICO website. After a year of. Increase your credit score.

If you already have a credit score in the 800s and you make payments on a car loan it wont increase much. Your credit score directly affects how much interest youll be paying on any loan and credit report discrepancies play a major role in interest. It may come to you as no surprise that making payments on your car will improve your credit score.

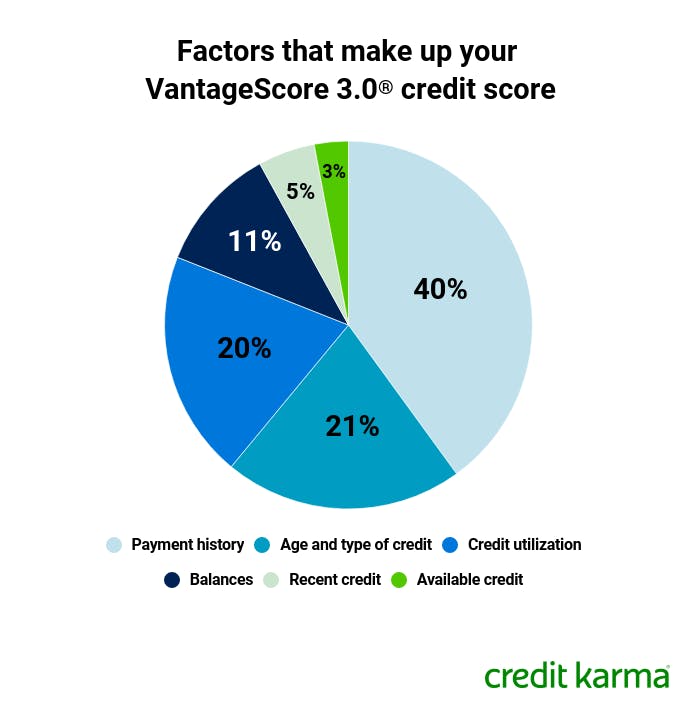

Ad Get Pre-Approved To See Your Real Terms For Every Vehicle. How can I raise my credit score by 100 points in 30 days. Both consider similar factors when determining your score though they weigh these factors.

Your score will increase as it satisfies all of the factors the. There are five factors that. Because keeping your auto loan can add or detract from your credit score its hard to say with certainty that paying off a car loan will boost it.

Generally speaking when you pay off a car loan or lease your credit score will take a mild hit. If a payment is late its recorded as 30 60 90 or 120 days late. Ad Get Pre-Approved To See Your Real Terms For Every Vehicle.

Average interest rate for new car loans. If you want to raise your credit score by 100 points in 30 days you shouldnt rush to buy a car with a loan. Here is how its calculated.

Access to all 3 Credit Scores now is more important than ever. Find out how much a car loan can affect your credit score and get tips on how to improve your credit score. What to do to increase your credit score after paying off a loan.

Payment history 35 percent credit utilizationamounts owed. Fortunately any temporary hits to your credit score will vanish as time passes. How Much Will Credit Score Increase After Paying Off My Car.

A credit score refers to the Credit Tip-Off Service CTOS score that ranges between 300 and 850. Oftentimes paying off a car loan will results in. Lenders usually decide upon loan approval based on your credit score.

In fact your payment history has the largest impact on your credit score. How an auto loan can help your credit score. When you make payments on time it.

Youre not alonemany people with car loans question when to pay it off. FICO Scores and VantageScores. There are two types of credit scores.

Your credit score will not increase after paying off your car loan. FICO scores are determined by five categories. In the event of a financial setback refinancing will reduce monthly auto loan payments.

Ad Improve your FICO Score Get Credit for the Bills Youre Already Paying. Paying off a car loan can allow more breathing space by reducing your. Average interest rate for used car loans.

Because a portion of your credit score is derived from credit mix getting a car loan may help your credit profile if you dont already have an installment loan. The answer potentially a lot. Get More Control Over your Financial Life.

Your payment history makes up a very large portion of your credit mix. The best range for your credit score is usually in the 700s and dipping down into the 600s can make a difference when it comes to financing potentially increasing new car prices. Pinpoint whats most affecting your scores.

If you already have a credit score in the 800s and you make payments on a car loan it wont increase much because the highest score is 850. You can get car loans in the UAE even if your credit score is somewhere in the low or very low category. Granted this method will make the auto loan drag on longer but at least.

It all depends on your situation. If you manage the repayments. How much your credit score will increase is determined by your starting point.

As you make on-time loan payments an auto loan will improve your credit score. New Credit Scores Take Effect Immediately. Throughout your life you build a credit score which can change over time.

Check our financing tips and find cars for sale that fit your budget. In a nutshell the FICO credit scoring formula the most commonly used scoring. However having a low credit score spikes up the HSBC interest rate for.

But if you have a low credit. Your credit score is a number between 300 and 850 on the FICO scale which is the most commonly used credit scoring model used by auto lenders.

7 Steps To Improve Your Credit Score Right Now Money

Credit Score Needed For Bank Of America Auto Loan

Can A Car Loan Improve My Credit Score Fiscal Tiger

What S The Minimum Credit Score For A Car Loan Credit Karma

What Makes A Good Credit Score And How To Improve Yours

The Fastest Way To Rebuild Bad Credit Mccarthy Auto Group Blog

How Do Car Loans Affect My Credit Score Capital One Auto Navigator

How To Get A Bad Credit Car Loan Mtn View Chevrolet Chattanooga

How To Get A Credit Score Over 800 In 4 Steps Acorns

What Is An Excellent Credit Score These Days

How Fast Will A Car Loan Raise My Credit Score Auto Credit Express

Car Loans And Credit Scores How The Two Interact Shopping Guides Nadaguides

Does A Car Loan Help My Credit Score Nerdwallet

How To Get A Car Loan With Bad Credit Ghs Fcu

If I Pay Off A Credit Card Will My Credit Score Change The Ascent

Fico Credit Score Auto Loans Auto Financing Vehicle Apr

How Do Car Loans Affect Your Credit Score Shift

Things Everyone Should Know About Car Loan With A 650 Credit Score Way Blog